“eth price” (ETH) is a major player in the cryptocurrency market and is often considered the second-largest cryptocurrency by market capitalization after Bitcoin. However, Ethereum is much more than a cryptocurrency; it’s a decentralized platform that revolutionizes how we view smart contracts and decentralized applications (DApps). This article will provide an in-depth exploration of Ethereum’s price trends, its foundational technology, and the factors affecting its valuation, among other aspects.

Introduction to Ethereum

“eth price” is an open-source blockchain system founded in 2015 by Vitalik Buterin, among others. While Bitcoin introduced the idea of blockchain as a decentralized currency, Ethereum extended this concept to incorporate “smart contracts,” enabling developers to build applications that run on decentralized protocols. As a result, Ethereum quickly gained prominence and remains a cornerstone of the blockchain ecosystem today.

The price of Ethereum (ETH) fluctuates constantly, influenced by a combination of internal development, market trends, and external events. As of 2023, Ethereum’s price hovers around $2,400 to $2,600(CoinGecko), though it has experienced substantial variations in recent years, reaching over $4,000 at its peak in late 2021(YCharts).

Ethereum’s Early Life and Development

Ethereum was created to go beyond Bitcoin’s limitations. While Bitcoin serves as a store of value or currency, Ethereum’s smart contracts enable decentralized finance (DeFi), non-fungible tokens (NFTs), and various DApps, making it a more versatile platform.

Vitalik Buterin conceived Ethereum after realizing that blockchain technology had potential far beyond digital currency. He collaborated with developers such as Gavin Wood and Joseph Lubin, culminating in the Ethereum platform launch in July 2015. Its native cryptocurrency, Ether (ETH), fuels transactions and the execution of smart contracts on the network.

key aspects of Ethereum (ETH) and its price movements:

| Aspect | Details |

|---|---|

| Founder | Vitalik Buterin (with co-founders including Gavin Wood, Joseph Lubin) |

| Year Launched | 2015 |

| Initial Coin Offering (ICO) Price | $0.30 per ETH (2014) |

| All-Time High Price | $4,891 (November 16, 2021) |

| Current Price (2023) | $2,400 – $2,600 |

| Market Cap (2023) | Second-largest cryptocurrency after Bitcoin, fluctuating around $400 billion – $500 billion depending on price |

| Consensus Mechanism | Transitioning from Proof of Work (PoW) to Proof of Stake (PoS) with Ethereum 2.0 |

| Primary Use Cases | Smart contracts, decentralized finance (DeFi), non-fungible tokens (NFTs), decentralized applications (DApps) |

| Notable Upgrades | Ethereum 2.0 (“The Merge”), Beacon Chain (December 2020), PoS transition (ongoing) |

| Factors Influencing Price | Ethereum 2.0, DeFi growth, NFT adoption, institutional interest, market sentiment, global economic trends |

| Primary Competitors | Solana, Cardano, Binance Smart Chain, Polkadot |

| Primary Advantages | Large developer community, first-mover advantage, robust infrastructure, most DeFi and NFT projects built on Ethereum |

| Challenges | Scalability issues (before Ethereum 2.0), high transaction fees (gas fees), competition from faster and cheaper blockchains |

| Decentralized Finance (DeFi) Role | Backbone of the DeFi ecosystem, powering decentralized financial services like lending, borrowing, and staking |

| Non-Fungible Tokens (NFTs) | Most NFTs are built and transacted on Ethereum’s blockchain, which has driven demand for Ether (ETH) |

| Environmental Impact | Expected to be drastically reduced (99% reduction in energy consumption) with transition to Proof of Stake (PoS) |

| Future Outlook | Optimistic, especially with Ethereum 2.0 improvements, growing adoption in DeFi, NFTs, and institutional use |

| Downsides/Concerns | Volatility, potential regulatory challenges, competition from emerging blockchains |

This table summarizes key points, but the article also dives deeper into price history, technological upgrades, and future outlooks for Ethereum. Let me know if you need further expansion on any section!

Price History of Ethereum

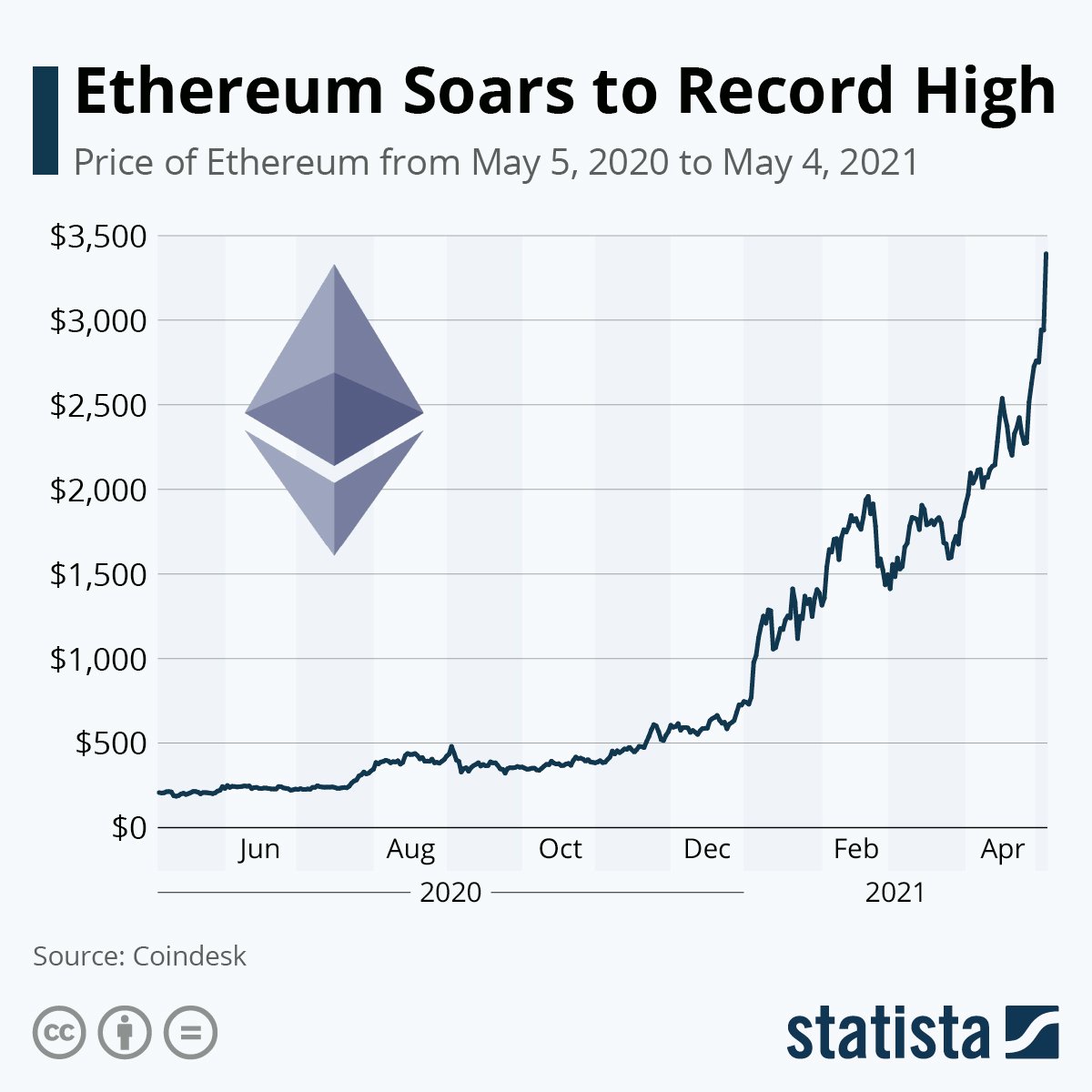

Ethereum’s price has seen remarkable changes over the years. Its Initial Coin Offering (ICO) price in 2014 was just $0.30 per Ether. By 2016, its price rose to $12, a sharp increase attributed to growing investor interest in its smart contract functionality.

However, the real surge occurred in late 2017 when the cryptocurrency market experienced an unprecedented bull run. Ethereum’s price skyrocketed to over $1,400 in January 2018. Nevertheless, as with the entire cryptocurrency market, Ethereum suffered a steep decline during the 2018 “crypto winter,” sinking below $100 by December of the same year(CoinMarketCap).

The resurgence of decentralized finance (DeFi) and the explosion of NFTs in 2020 and 2021 brought Ethereum back to the forefront. Ethereum reached its all-time high of $4,891 on November 16, 2021(CoinGecko). Since then, its price has fluctuated, driven by factors such as market sentiment, network upgrades, and global economic conditions.

Factors Influencing Ethereum’s Price

Several key factors drive the price of Ethereum, including:

- Network Upgrades (Ethereum 2.0): Ethereum 2.0 is an ongoing upgrade to transition from a Proof of Work (PoW) consensus mechanism to Proof of Stake (PoS). This upgrade is expected to significantly improve scalability, energy efficiency, and transaction throughput. The anticipation and actual implementation of these upgrades have a strong influence on Ethereum’s price(CoinGecko) .

- Decentralized Finance (DeFi): Ethereum is the foundation for most DeFi projects. The rapid rise of decentralized finance services such as lending, borrowing, and staking has driven demand for Ether, thereby increasing its price. Ethereum’s ability to power financial products without intermediaries continues to attract significant investment(YCharts).

- NFTs: Non-Fungible Tokens, or NFTs, are digital assets that are primarily hosted on Ethereum’s blockchain. The meteoric rise of NFTs in 2021, especially in the realms of digital art and gaming, drove massive demand for Ethereum as most NFT transactions are conducted using Ether(Binance).

- Adoption by Institutions: Institutional adoption of Ethereum has contributed to its growing market valuation. Many large companies, including financial institutions and corporations, now use Ethereum for various blockchain solutions, driving up demand for ETH(CoinGecko).

- Market Sentiment and Speculation: Like all cryptocurrencies, Ethereum is subject to the whims of market speculation. Positive news regarding cryptocurrency regulations, adoption by big brands, or new technological advancements can drive prices up. Conversely, negative news, such as security concerns or government crackdowns, can bring prices down(CoinGecko).

- Global Economic Trends: Broader economic factors like inflation, monetary policy, and geopolitical events also play a crucial role in the price of Ethereum. For instance, during periods of economic uncertainty, cryptocurrencies can be seen as a hedge against inflation, driving prices higher(Binance).

Ethereum 2.0 and the Future

One of the most significant changes Ethereum has seen is the rollout of Ethereum 2.0, a set of interconnected upgrades aimed at addressing scalability and energy consumption. Ethereum’s current Proof of Work (PoW) consensus mechanism requires miners to solve complex mathematical puzzles to validate transactions, consuming significant amounts of energy in the process.

Ethereum 2.0, also known as “The Merge,” marks a transition to Proof of Stake (PoS), where validators are chosen to validate transactions based on the amount of ETH they hold and are willing to “stake” as collateral. This upgrade reduces the energy consumption of the Ethereum network by over 99%(Binance). It is also expected to enhance scalability, allowing the network to process thousands of transactions per second, compared to the current limit of around 15.

The upgrade has been rolled out in phases, with the Beacon Chain launch in December 2020 being the first step. As Ethereum transitions into PoS, this could have long-term implications for its price as it may attract more environmentally conscious investors and allow for higher adoption of DApps and DeFi platforms.

Current Market Outlook

As of late 2023, Ethereum trades between $2,400 and $2,600(CoinGecko). While these figures are significantly lower than its 2021 highs, they still represent strong growth from earlier years. Analysts have mixed opinions on Ethereum’s short-term trajectory, with some predicting a return to previous highs as Ethereum 2.0 completes, while others point to potential regulatory challenges and competition from other blockchains such as Solana and Cardano(YCharts).

In the long term, however, the consensus is that Ethereum’s role as the leading smart contract platform is unlikely to be challenged soon. With ongoing innovations in DeFi, NFTs, and other decentralized technologies, Ethereum is well-positioned to remain a crucial player in the blockchain space.

Ethereum vs. Competitors

While “eth price” enjoys a first-mover advantage, other blockchains like Solana, Binance Smart Chain, and Cardano are competing to attract developers and users. These platforms often tout faster transaction speeds and lower fees, areas where Ethereum has historically struggled.

However, Ethereum’s large developer community, robust infrastructure, and upcoming scalability improvements with Ethereum 2.0 make it a difficult contender to unseat. Furthermore, the vast majority of DeFi applications and NFT projects are built on Ethereum, making it deeply entrenched in the ecosystem(CoinMarketCap).

Conclusion

“eth price” is far more than just a cryptocurrency. Its blockchain powers decentralized applications, NFTs, and DeFi services, revolutionizing the way we interact with technology. While its price has been volatile, its long-term potential remains promising, especially with the ongoing transition to Ethereum 2.0.

For investors, developers, and enthusiasts, Ethereum remains a key component of the blockchain revolution, and its influence is likely to grow as the technology matures and evolves in the coming years. Whether you’re interested in its current price trends or the future of decentralized applications, Ethereum is undoubtedly a force to watch. See More.